Transaction Monitoring System Validation

Transaction monitoring by compliancewise provides predefined workflows including obligated steps that allow institutions to identify unusual transactions properly and in good time.

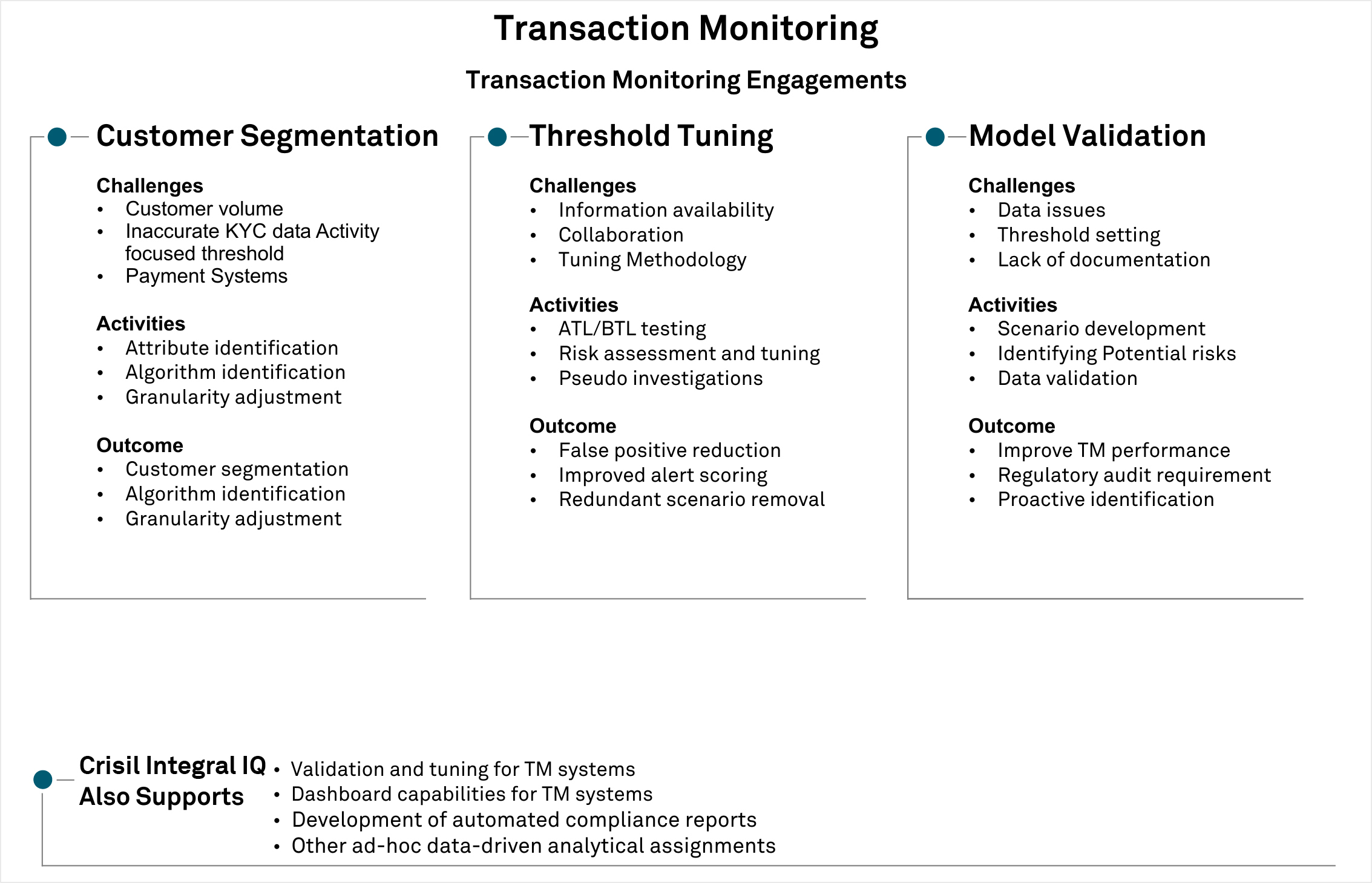

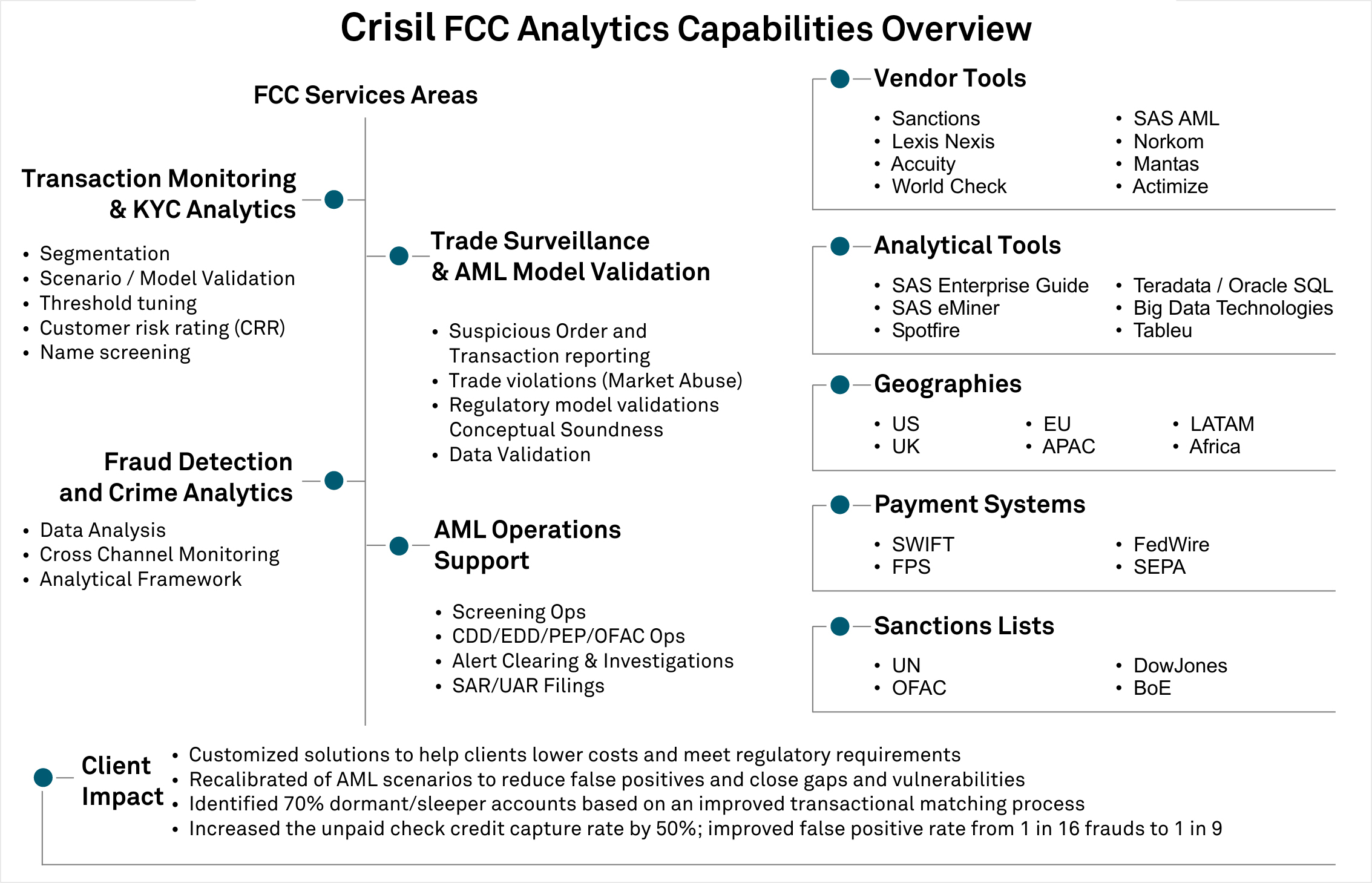

Transaction monitoring system validation. For many financial institutes the current validation of e g. In recent years on going testing and model validation compliance has seen increased focus and scrutiny from global regulators. A transaction monitoring product in its most basic form is not a model. The independent validation should also verify the policies in place and that management is complying with those policies.

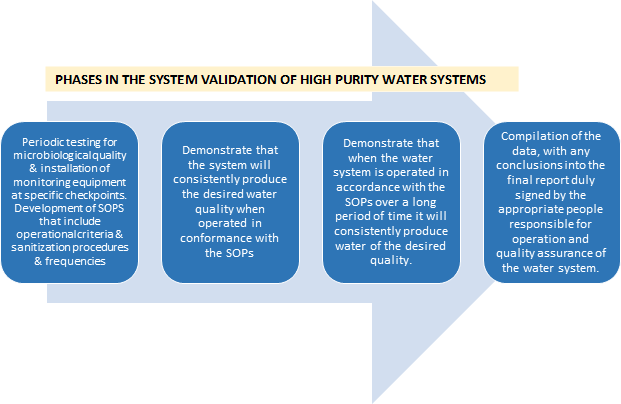

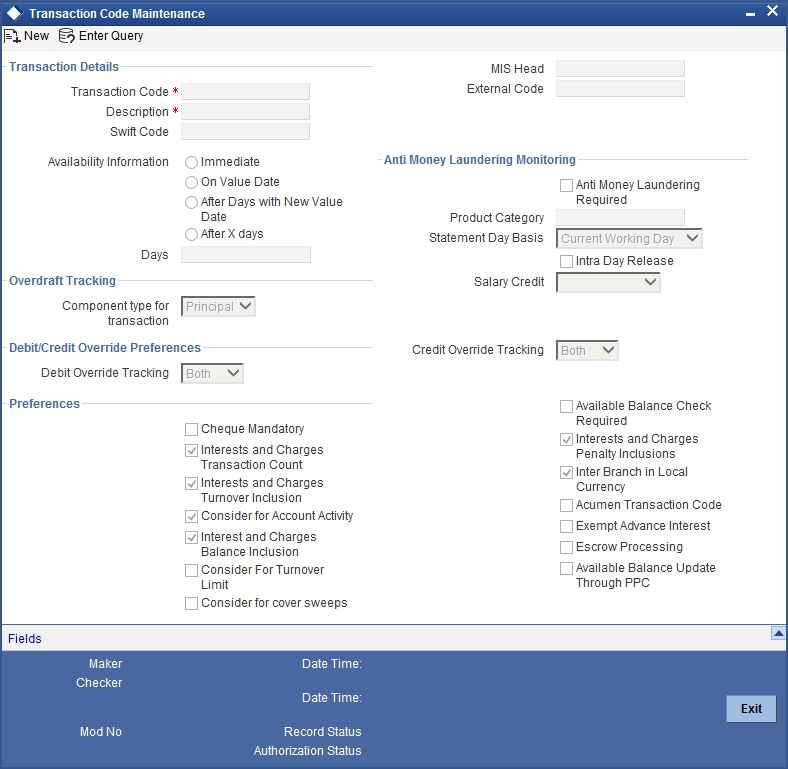

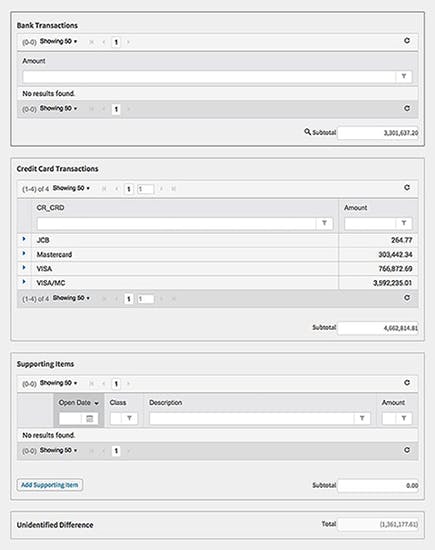

While a model validation is required periodically a data integrity review may be warranted more frequently at least annually particularly if an institution has new transaction codes a conversion of integrated systems or mergers and acquisitions. Additionally it provides the possibility to upload and store all relevant documentation within the system allowing easy access to any information needed for. Calibration testing of parameters should be part of a model validation. Meeting regulatory requirements by implementing a systematic tm system validation methodology.

Aml models include transaction monitoring software vendor products large homegrown transaction monitoring systems customer risk rating models if with a quantitative scoring component and alert risk scoring models again if with a quantitative scoring component. Identification of the types of customers products and services that are included within. The evaluation of. Validation services include testing the accuracy and integrity of the transaction monitoring system to determine whether the application is functioning as intended.

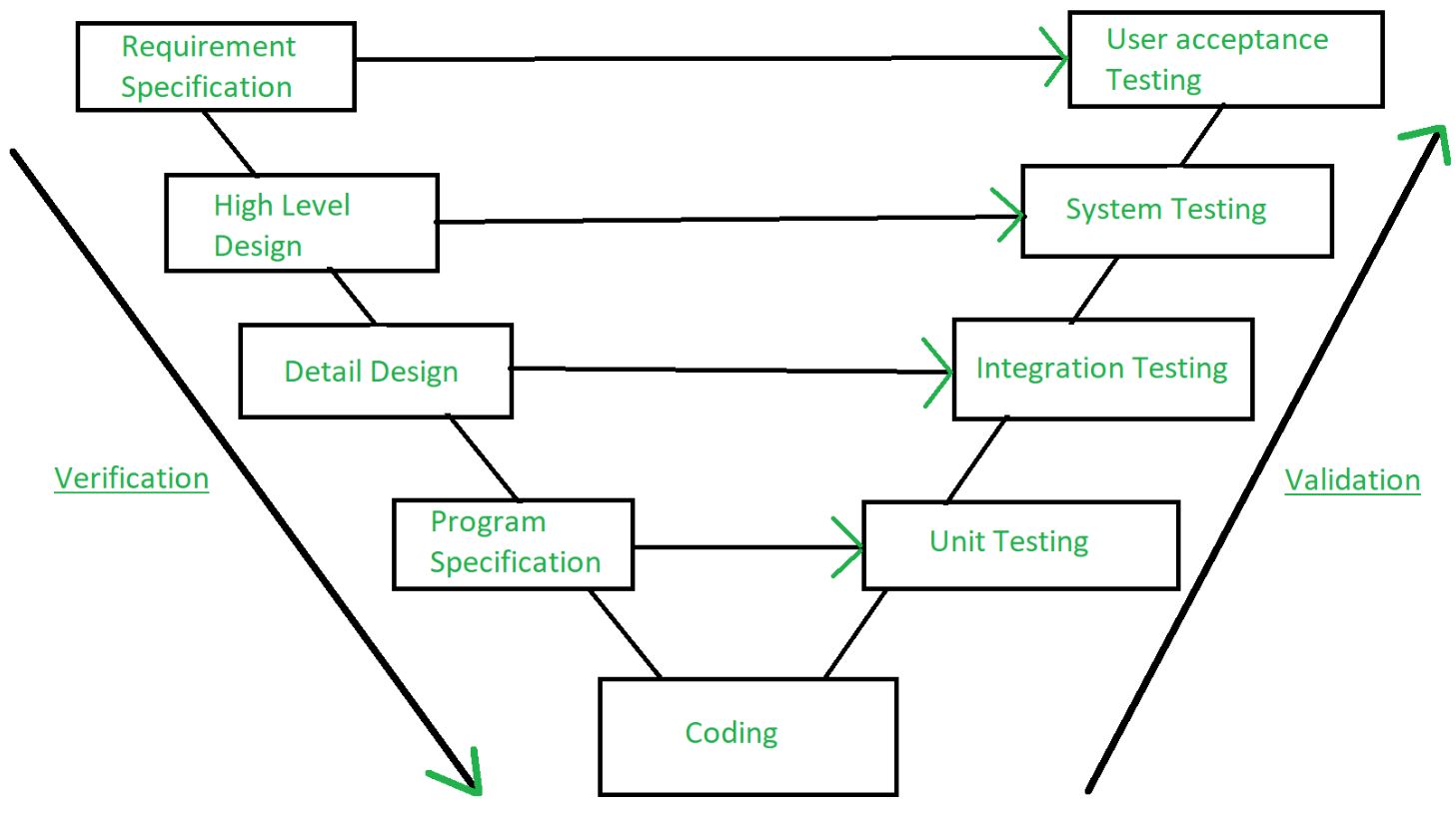

In addition the monitoring system s programming methodology and effectiveness should be independently validated to ensure that the models are detecting potentially suspicious activity. However under 3 nycrr 504 3 a 2 regulated entities systems and programs must be reviewed and periodically updated at risk based intervals and thus regulated institutions are expected to conduct periodic risk based systems testing and data validation on all systems that support the transaction monitoring and filtering program. This means that the setup and overhead costs are high when organizations recognize that certain crucial elements are not adequately documented or dispersed across the organization making the start of a full scale validation. A transaction monitoring system sometimes referred to as a manual transaction monitoring system typically targets specific types of transactions e g those involving large amounts of cash those to or from foreign geographies and includes a manual review of various reports generated by the bank s mis or vendor systems in order to identify.

A transaction monitoring system is a first time exercise.